UP-TO-DATE

BUSINESS

HOME STUDY CIRCLE LIBRARY

EDITED BY

SEYMOUR EATON

UP TO DATE

BUSINESS

INCLUDING

LESSONS IN BANKING, EXCHANGE,

BUSINESS GEOGRAPHY, FINANCE,

TRANSPORTATION AND

COMMERCIAL LAW

FROM THE CHICAGO RECORD

NEW YORK

THE DOUBLEDAY & McCLURE CO.

1900

Copyright, 1897, 1898, 1899, by the Chicago Record

Copyright, 1899, by Seymour Eaton

Copyright, 1899, 1900, by Victor F. Lawson

[v]CONTENTS

I

GENERAL BUSINESS INFORMATION

| Page | ||

|---|---|---|

| I. | Commercial Terms and Usages | 3 |

| II. | Commercial Terms and Usages (Continued) | 4 |

| III. | Bank Cheques | 6 |

| IV. | Bank Cheques (Continued) | 8 |

| V. | Bank Cheques (Continued) | 12 |

| VI. | Bank Drafts | 15 |

| VII. | Promissory Notes | 18 |

| VIII. | The Clearing-house System | 21 |

| IX. | Commercial Drafts | 26 |

| X. | Foreign Exchange | 31 |

| XI. | Letters of Credit | 37 |

| XII. | Joint-stock Companies | 41 |

| XIII. | Protested Paper | 46 |

| XIV. | Paper Offered for Discount | 49 |

| XV. | Corporations | 51 |

| XVI. | Bonds | 54 |

| XVII. | Transportation | 57 |

| XVIII. | Transportation Papers | 59 |

| Examination Paper | 64 | |

II

BUSINESS GEOGRAPHY

Trade Features

| I. | The Trade Features of the British Isles | 69 |

| [vi]II. | """"France | 94 |

| III. | """"Germany | 102 |

| IV. | """"Spain and Italy | 111 |

| V. | """"Russia | 120 |

| VI. | """"India | 129 |

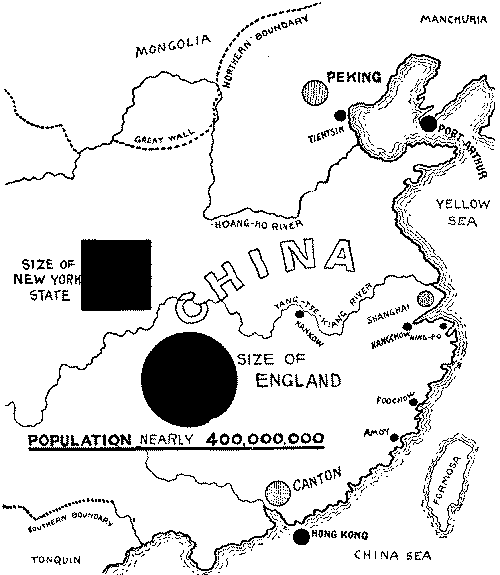

| VII. | """"China | 139 |

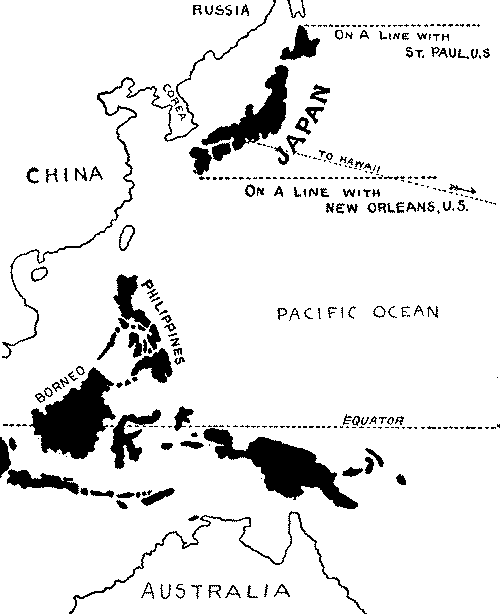

| VIII. | """"Japan | 148 |

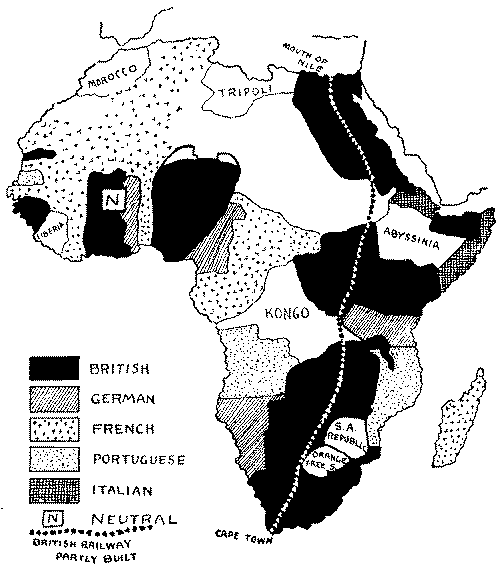

| IX. | """"Africa | 157 |

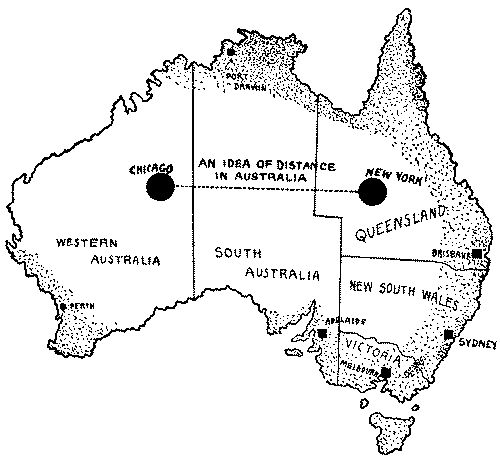

| X. | """"Australia and Australasia | 166 |

| XI. | """"South America | 177 |

| XII. | """"Canada | 187 |

| XIII. | """"The United States | 194 |

| Examination Paper | 210 |

III

FINANCE, TRADE, AND TRANSPORTATION

| I. | National and State Banks | 215 |

| II. | Savings Banks and Trust Companies | 221 |

| III. | Corporations and Stock Companies | 225 |

| IV. | Borrowing and Loaning Money | 228 |

| V. | Collaterals and Securities | 233 |

| VI. | Cheques, Drafts, and Bills of Exchange | 240 |

| VII. | The Clearing-house System | 248 |

| VIII. | Commercial Credits and Mercantile Agencies | 254 |

| IX. | Bonds | 263 |

| X. | Transportation by Rail | 267 |

| XI. | Freight Transportation | 274 |

| XII. | Railroad Rates | 281 |

| XIII. | Stock and Produce Exchanges | 288 |

| XIV. | Storage and Warehousing | 294 |

| Examination Paper | 301 |

[vii]IV

COMMERCIAL LAW

| I. | The Different Kinds of Contracts | 309 |

| II. | The Parties to a Contract | 312 |

| III. | The Parties to a Contract (Continued) | 315 |

| IV. | The Consideration in Contracts | 318 |

| V. | The Essentials of a Contract | 321 |

| VI. | Contracts by Correspondence | 326 |

| VII. | What Contracts Must Be in Writing | 332 |

| VIII. | Contracts for the Sale of Merchandise | 336 |

| IX. | The Warranties of Merchandise | 340 |

| X. | Common Carriers | 344 |

| XI. | The Carrying of Passengers | 347 |

| XII. | On the Keeping of Things | 350 |

| XIII. | Concerning Agents | 353 |

| XIV. | The Law Relating to Bank Cheques | 358 |

| XV. | The Law Relating to Leases | 363 |

| XVI. | Liability of Employers to Employés | 369 |

| XVII. | Liability of Employers to Employés | 373 |

| Examination Paper | 377 |

V

PREPARING COPY FOR THE PRESS

AND PROOF-READING

| I. | Preparing Copy | 381 |

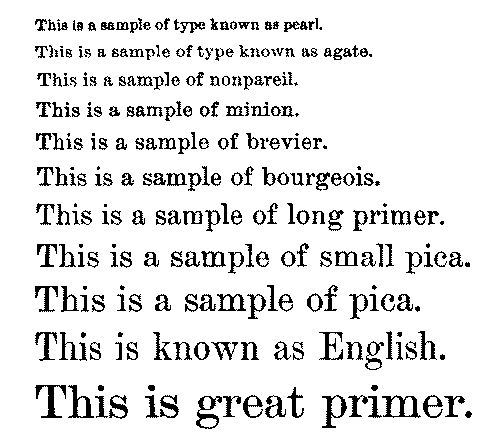

| II. | On the Names and Sizes of Type | 382 |

| III. | The Terms Used in Printing | 384 |

| IV. | Marks Used in Proof-reading | 387 |

[ix]ILLUSTRATIONS

I

GENERAL BUSINESS INFORMATION

| Page | ||

|---|---|---|

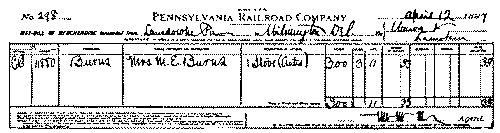

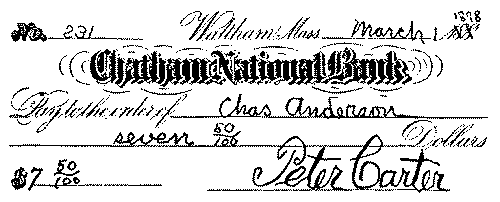

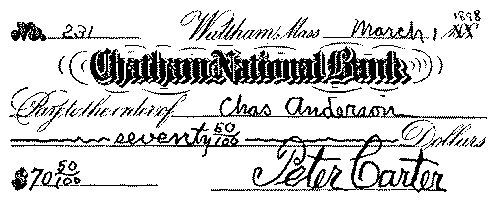

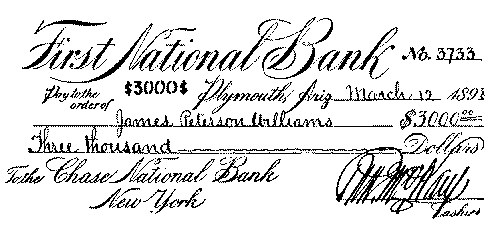

| A Poorly Drawn Cheque | 7 | |

| A Carefully Drawn Cheque | 8 | |

| A Cheque Drawn so as to Insure Payment to Proper Party | 9 | |

| A Cheque Payable to Order | 11 | |

| A Blank Indorsement | 11 | |

| A Cheque Made to Obtain Money for Immediate Use | 13 | |

| A Certified Cheque | 14 | |

| A Cheque for the Purchase of a Draft | 16 | |

| A Bank Draft | 17 | |

| Ordinary Form of Promissory Note | 18 | |

| A Promissory Note Filled Out in an Engraved Blank | 19 | |

| A Special Form for a Promissory Note | 20 | |

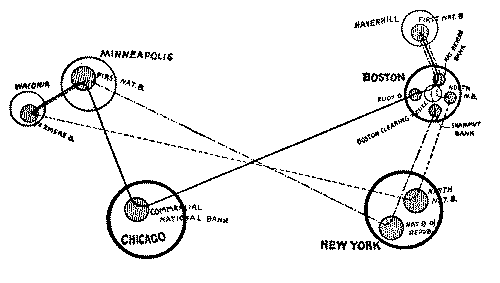

| The Advantages of the Clearing-house System | 22 | |

| The Route of a Cheque | 24 | |

| Backs of Two Paid Cheques | 25 | |

| A Sight Draft Developed from Letter | 27 | |

| A Sight Draft | 28 | |

| An Accepted Ten-day Sight Draft | 28 | |

| An Accepted Sight Draft | 29 | |

| A Time Draft | 29 | |

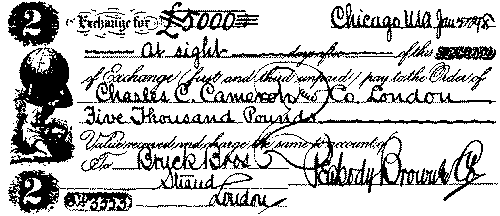

| Foreign Exchange | 32 | |

| A Bill of Exchange (Private) | 35 | |

| A Bill of Exchange (Banker's) | 36 | |

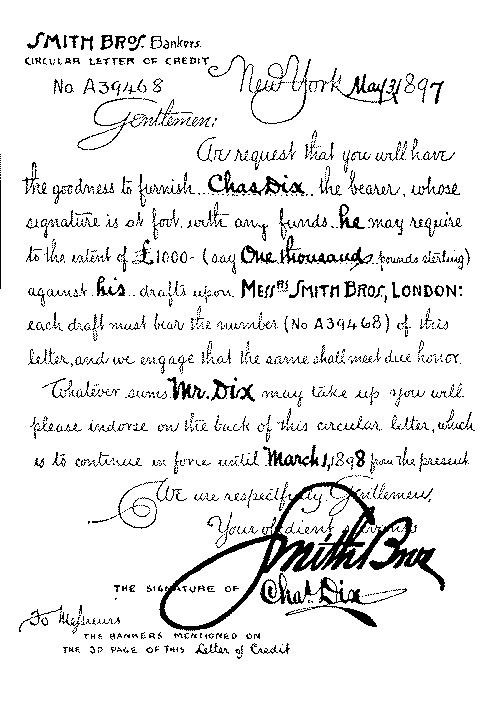

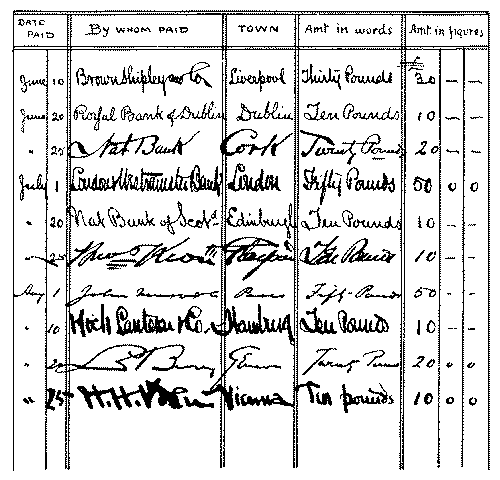

| First Page of a Letter of Credit | 38 | |

| Second Page of a Letter of Credit | 40 | |

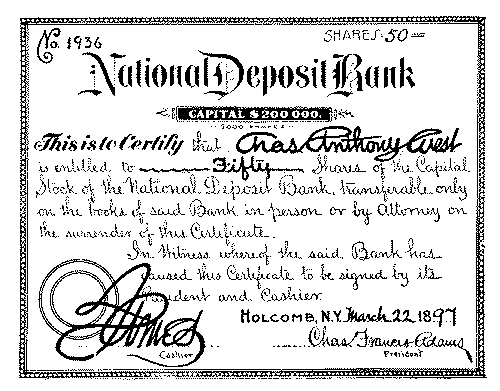

| A Certificate of Stock in a National Bank | 42 | |

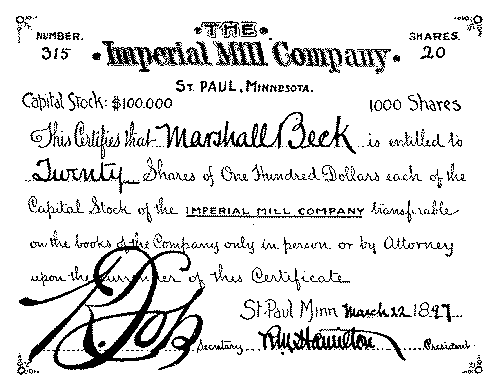

| [x]A Certificate of Stock in a Manufacturing Company | 43 | |

| A Protest | 48 | |

| A Private Bond | 55 | |

| A Shipping Receipt ("Original") | 60 | |

| A Steamship Bill of Lading | 61 | |

| A Local Waybill | 62 | |

II

BUSINESS GEOGRAPHY

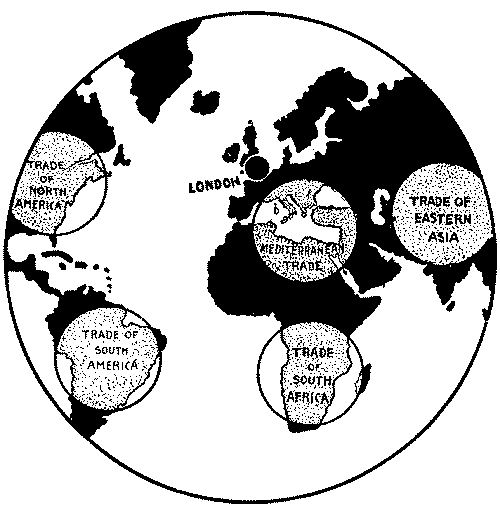

| London the Natural Centre of the World's Trade | 72 | |

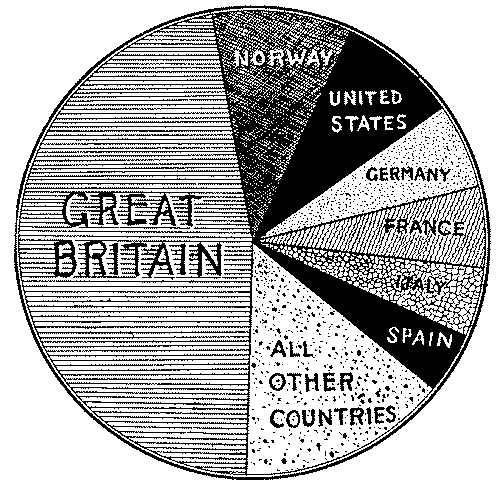

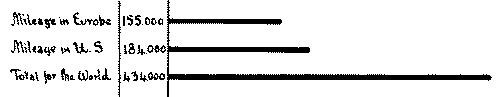

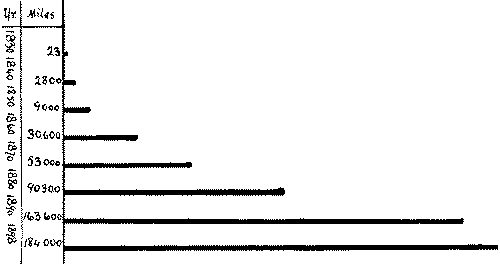

| British Mercantile Marine | 74 | |

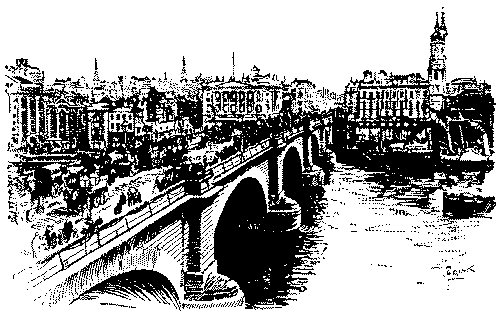

| London Bridge | 76 | |

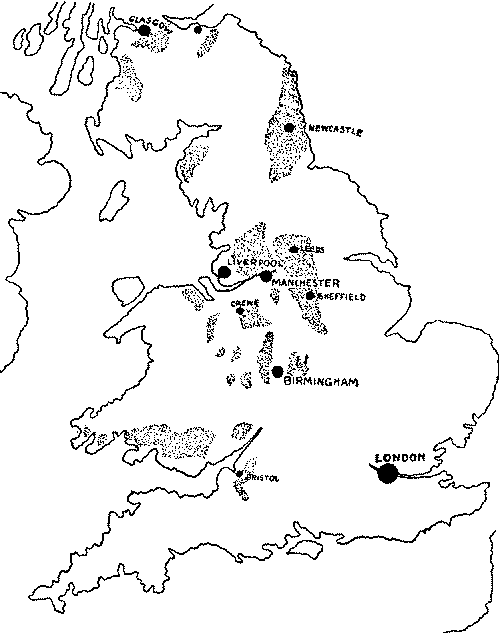

| The Coal-fields of England | 80 | |

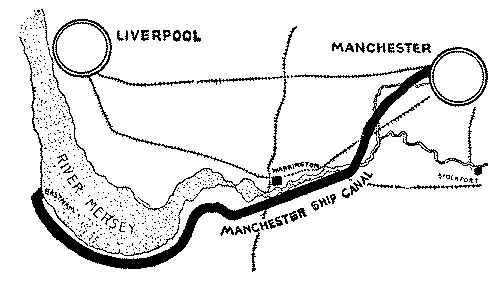

| The Manchester Ship Canal | 84 | |

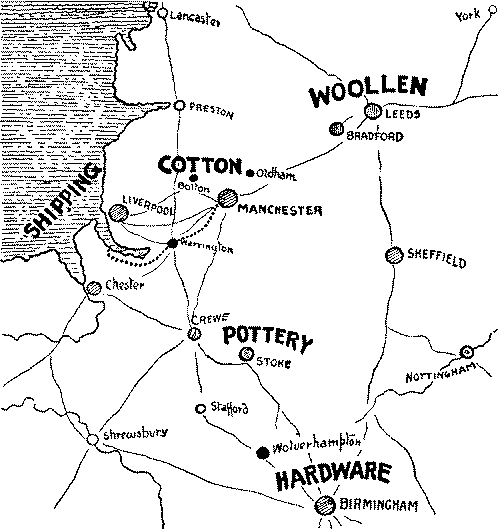

| The Great Manufacturing Districts of England | 88 | |

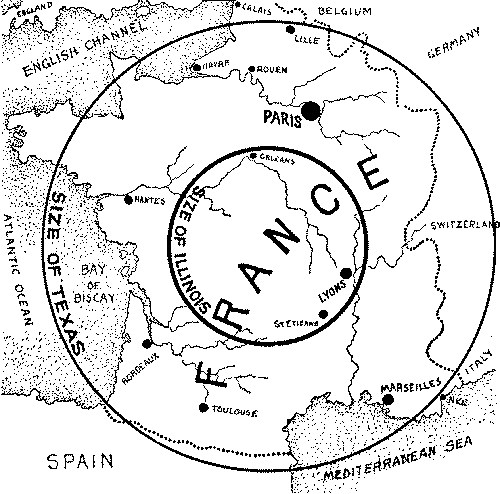

| France Compared in Size with the States of Illinois and Texas | 95 | |

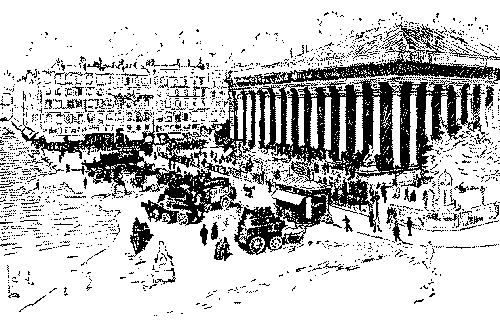

| Street Scene in Paris, Showing the Bourse | 97 | |

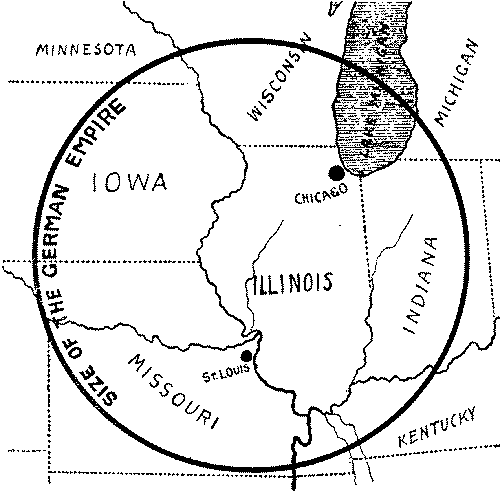

| Approximate Size of the German Empire | 104 | |

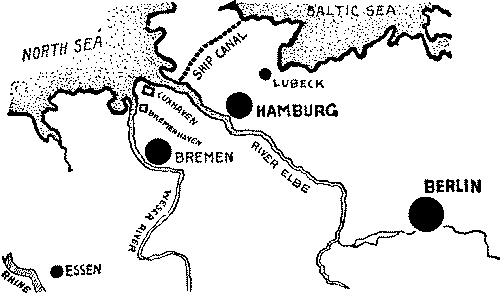

| North Central Germany, Showing the Ship Canal and the Leading Commercial Centres | 109 | |

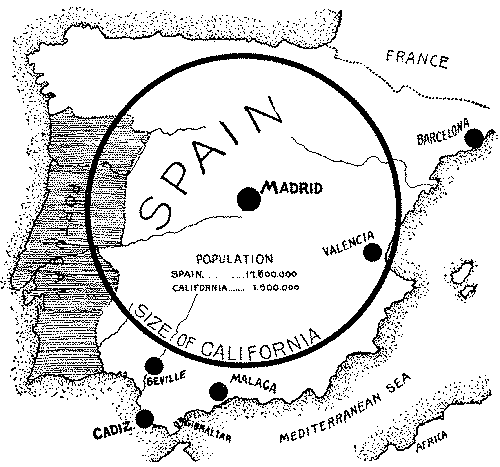

| Spain Compared in Size with California | 113 | |

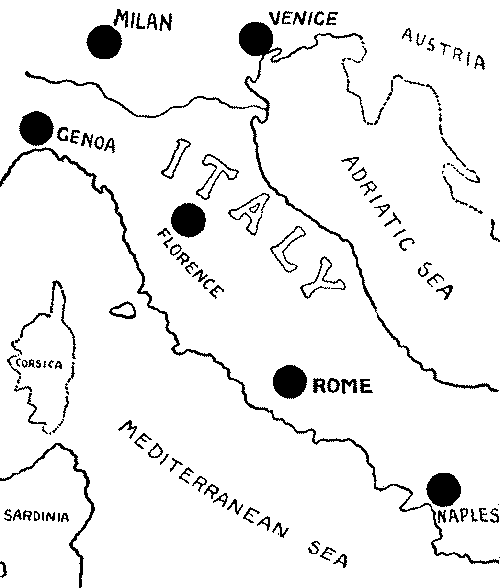

| Italy and its Chief Commercial Centres | 117 | |

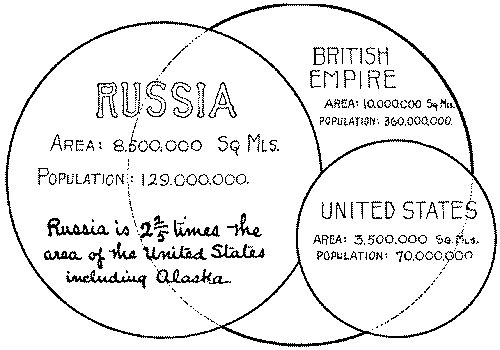

| Russia, the British Empire, and the United States Compared | 121 | |

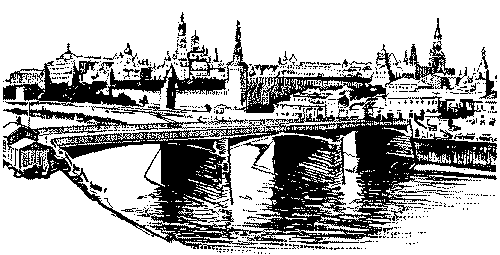

| Moscow | 127 | |

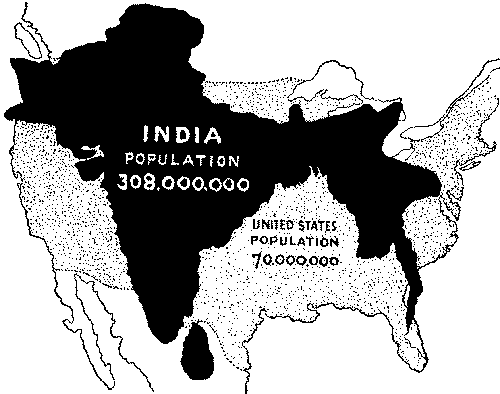

| Comparative Sizes of India and the United States | 133 | |

| China and its Chief Trade Centres | 145 | |

| Japan's Relation to Eastern Asia | 155 | |

| The Partition of Africa | 159 | |

| Australia | 171 | |

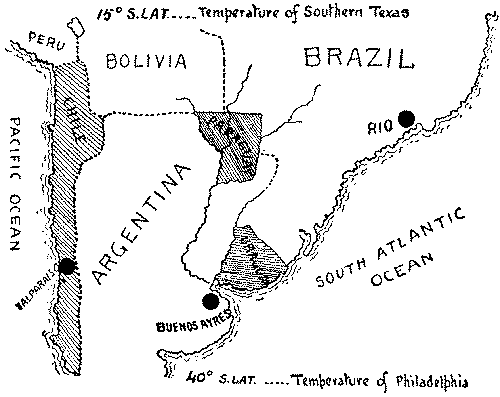

| The Most Prosperous Part of South America | 183 | |

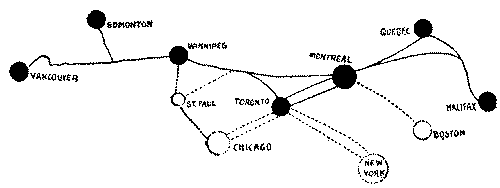

| Trade Centres of Canada and Trunk Railway Lines | 192 | |

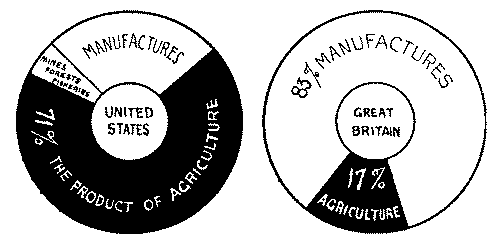

| Export Trade of United States and Great Britain Compared | 198 | |

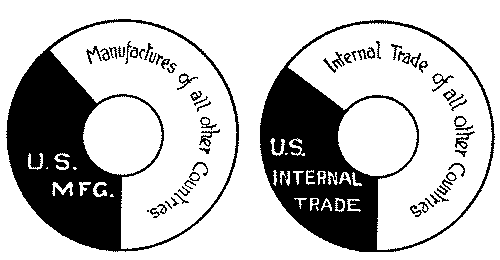

| [xi]United States Manufactures and Internal Trade Compared with the Manufactures and Internal Trade of all Other Countries | 199 | |

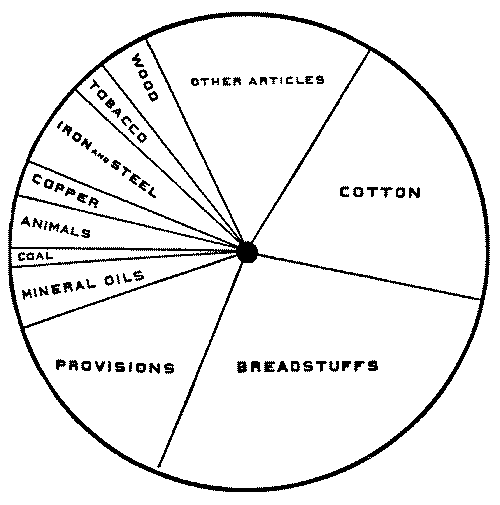

| Principal Articles of Domestic Exports of the United States | 205 | |

III

FINANCE, TRADE, AND TRANSPORTATION

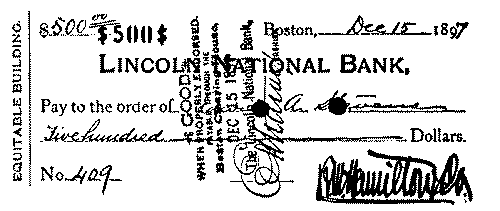

| The Bank of England | 216 | |

| Showing Cheque Raised from $7.50 to $70.50 | 241 | |

| A Certified Cheque | 244 | |

| A Bank Draft | 245 | |

| A Bill of Exchange | 246 | |

| Illustrating Cheque Collections | 252 | |

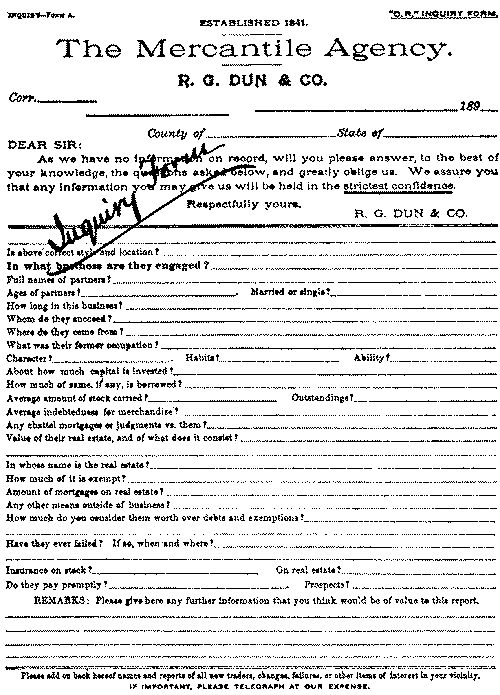

| A Mercantile Agency Inquiry Form | 259 | |

| Specimens of Interest Coupons | 266 | |

| Judge Thomas M. Cooley, First Chairman of the Interstate Commerce Commission | 287 | |

| The Paris Bourse | 289 | |

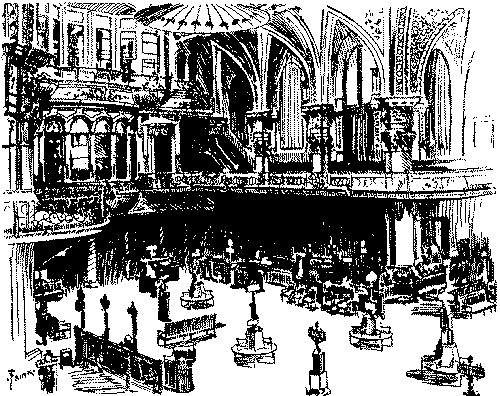

| Interior View of New York Stock Exchange | 290 | |

V

PREPARING COPY FOR THE PRESS

AND PROOF-READING

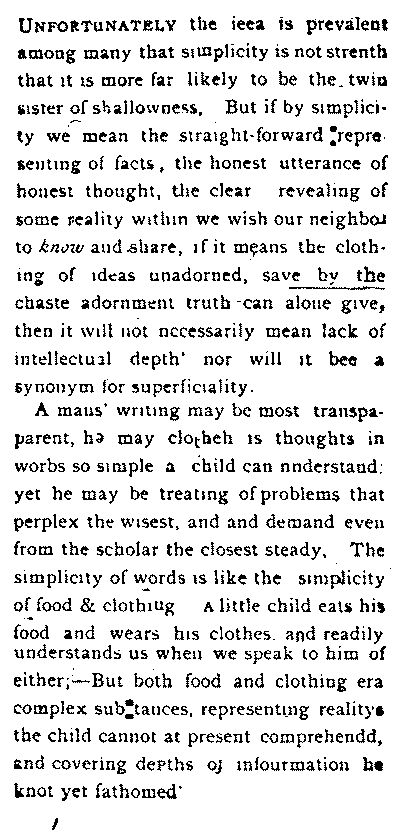

| A Printer's Proof | 390 | |

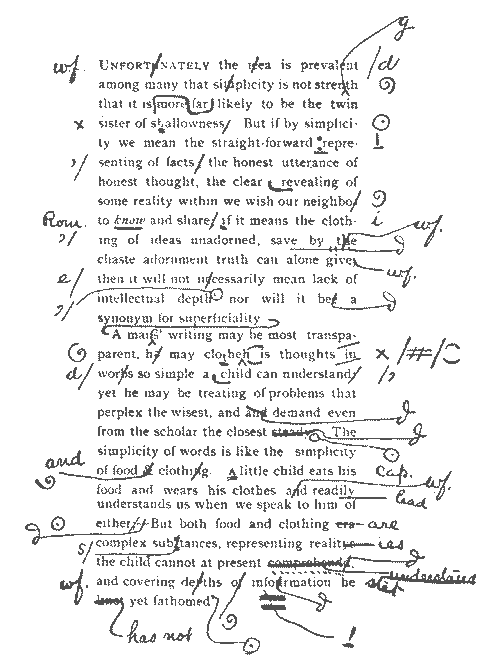

| A Printer's Corrected Proof | 391 | |

[3]GENERAL BUSINESS INFORMATION

I. COMMERCIAL TERMS AND USAGES

HERE is a distinction between the usage of the names commerce and business. The interchange of products and manufactured articles between countries, or even between different sections of the same country, is usually referred to as commerce. The term business refers more particularly to our dealings at home—that is, in our own town or city. Sometimes this name is used in connection with a particular product, as the coal business or the lumber business, or in connection with a particular class, as the dry-goods business or the grocery business. The name commerce, however, seldom admits of a limited application. In the United States trade is synonymous with business. The word traffic applies more especially to the conveyance than to the exchange of products; thus we refer to railroad traffic or lake traffic. Products, when considered articles of trade, are called merchandise, goods, wares. The term merchandise has the widest meaning, and includes all kinds of movable articles bought or sold. Goods is applied more particularly to the supplies of a merchant. Wares is commonly applied to utensils, as glassware, hardware, etc.

Gross commonly means coarse or bulky. In trade it is used with reference to both money and goods. The gross weight of a package includes the weight of the case or[4] wrappings. The larger sum in an account or bill—that is, the sum of money before any allowance or deductions are made—is the gross amount of the bill. The word net is derived from a Latin word meaning neat, clean, unadulterated, and indicates the amount of goods or money after all the deductions have been made. To say that a price is net is to indicate that no further discount will be made.

The word firm relates to solidity, establishment, strength, and in a business sense signifies two or more persons united in partnership for the purpose of trading. The word house is very frequently used in the same sense. In mercantile usage house does not mean the building in which the business is conducted, but the men who own the business, including, perhaps, the building, stock, plant, and business reputation. The name concern is often used in a very similar way.

The name market expresses a locality for the sale of goods, and in commerce is often used to denote cities or even countries. We say that Boston is a leather market, meaning that a large number of Boston merchants buy and sell leather. In the same sense we call Chicago a grain market, or New Orleans a cotton market. In its more restricted sense the name market signifies a building or place where meat or produce is bought and sold. We say that the market is flooded with a particular article when dealers are carrying more of that article than they can find sale for. There is no market for any product when there is no demand. The money market is tight or close when it is difficult to borrow money from banks and money-lenders.

II. COMMERCIAL TERMS AND USAGES (Continued)

The natural resources of a country are mainly the mineral commodities and agricultural produce that it[5] yields. The lumber and fish produced in a country are also among its natural resources. The positions and industries of cities are usually fixed by natural conditions, but the most powerful agent is the personal energy of enterprising and persevering men, who, by superior education, or scientific knowledge, or practical foresight, have often been able to found industrial centres in situations which no geographical considerations would suggest or explain.

Commission merchants receive and sell goods belonging to others for a compensation called a commission. A selling agent is a person who represents a manufacturing establishment in its dealings with the trade. The factory may be located in a small town, while the selling agent has his office and samples in the heart of a great city. As regards the quantity of goods bought or sold in a single transaction, trade is divided into wholesale and retail. The wholesale dealer sells to other dealers, while the retail dealer sells to the consumer—that is, the person who consumes, or uses, the goods. A jobber is one who buys from importers and manufacturers and sells to retailers. He is constantly in the market for bargains. The names jobber and wholesaler are often used in the same sense, but a jobber sometimes sells to wholesalers. Wholesale has reference to the quantity the dealer sells, and not to the source from which he buys, or the person to whom he sells. The wholesaler, as a rule, deals in staples—that is, goods which are used season after season—though of course there are wholesalers in practically all businesses.

Wholesale dealers send out travellers or drummers, who carry samples of the goods. Frequently the traveller starts out with his samples from six months to a year in advance of the time of delivery. It is quite a common thing for the retailer to order from samples[6] merchandise which at the time of placing the order may not even be manufactured.

By the price of a commodity is meant its value estimated in money, or the amount of money for which it will exchange. The exchangeable value of commodities depends at any given period partly upon the expense of production and partly upon the relation of supply and demand. Prices are affected by the creation of monopolies, by the opening of new markets, by the obstructing of the ordinary channels of commercial intercourse, and by the anticipation of these and other causes. It is the business of the merchant to acquaint himself with every circumstance affecting the prices of the goods in which he deals.

The entire world is the field of the modern merchant. He buys raw and manufactured products wherever he can buy cheapest, and he ships to whatever market pays him the highest price. Our corner grocer or produce-dealer may furnish us with beef from Texas, potatoes from Egypt, celery from Michigan, onions from Jamaica, coffee from Java, oranges from Spain, and a hundred other things from as many different points; and yet, so complete is the interlocking of the world's commercial interests, and so great is the speed of transportation, that he can supply us with these necessaries under existing conditions more easily and readily than if they were all grown on an adjoining farm.

III. BANK CHEQUES

A cheque is an order for money, drawn by one who has funds in the bank. It is payable on demand. In reality, it is a sight draft on the bank. Banks provide blank cheques for their customers, and it is a very simple matter to fill them out properly. In writing in the amount begin at the extreme left of the line.

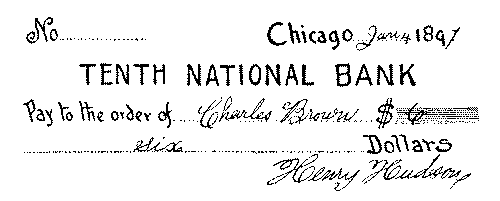

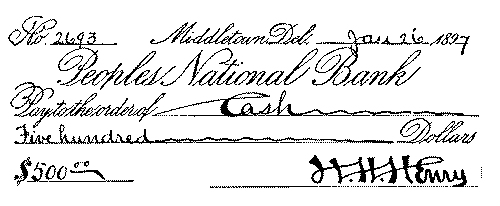

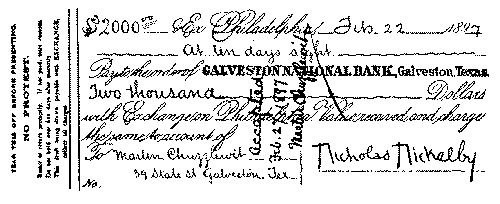

[7]The illustration given below shows a poorly written cheque and one which could be very easily raised. A fraudulent receiver could, for instance write, "ninety" before the "six" and "9" before the figure "6," and in this way raise the cheque from $6 to $96. If this were done and the cheque cashed, the maker, and not the bank, would become responsible for the loss. You cannot hold other people responsible for your own carelessness. A cheque has been raised from $100 to $190 by writing the words "and ninety" after the words "one hundred." One of the ciphers in the figures was changed to a "9" by adding a tail to it. It is wise to draw a running line, thus ~~~~~~, after the amount in words, thus preventing any additional writing.

The illustration on page 8 shows a cheque carefully and correctly drawn. The signature should be in your usual style, familiar to the paying teller. Sign your name the same way all the time. Have a characteristic signature, as familiar to your friends as is your face.

A cheque is a draft or order upon your bank, and it need not necessarily be written in the prescribed form. Such an order written on a sheet of note-paper with[8] a lead-pencil might be in every way a legally good cheque.

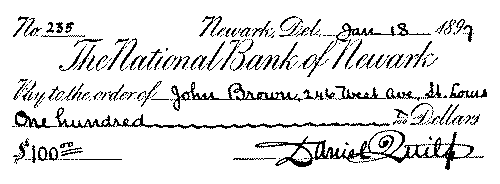

Usually cheques should be drawn "to order." The words "Pay to the order of John Brown" mean that the money is to be paid to John Brown, or to any person that he orders it paid to. If a cheque is drawn "Pay to John Brown or Bearer" or simply "Pay to Bearer," any person that is the bearer can collect it. The paying teller may ask the person presenting the cheque to write his name on the back, simply to have it for reference.

In writing and signing cheques use good black ink and let the copy dry a little before a blotter is used.

The subject of indorsements will be treated in a subsequent lesson.

IV. BANK CHEQUES (Continued)

The banks of this country make it a rule not to cash a cheque that is drawn payable to order, unless the person presenting the cheque is known at the bank, or unless he satisfies the paying teller that he is really the person to whom the money should be paid. It must be remembered[9] however, that a cheque drawn to order and then indorsed in blank by the payee is really payable to bearer, and if the paying teller is satisfied that the payee's signature is genuine he will not likely hesitate to cash the cheque. In England all cheques apparently properly indorsed are paid without identification.

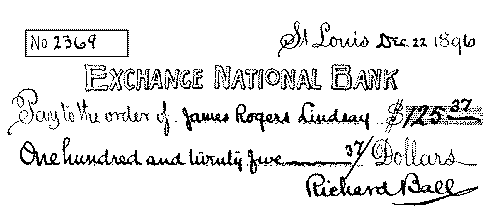

In drawing a cheque in favour of a person not likely to be well known in banking circles, write his address or his business after his name on the face of the cheque. For instance, if you should send a cheque to John Brown, St. Louis, it might possibly fall into the hands of the wrong John Brown; but if you write the cheque in favour of "John Brown, 246 West Avenue, St. Louis," it is more than likely that the right person will collect it.

If you wish to get a cheque cashed where you are unknown, and it is not convenient for a friend who has an account at the bank to go with you for the purpose of identification, ask him to place his signature on the back of your cheque, and you will not likely have trouble in getting it cashed at the bank where your friend keeps his account. By placing his signature upon the back of the cheque he guarantees the bank against loss. A bank[10] is responsible for the signatures of its depositors, but it cannot be supposed to know the signatures of indorsers. The reliable identifier is in reality the person who is responsible.

INDORSING CHEQUES

- In indorsing cheques note the following points:

- Write across the back—not lengthwise.

- If your indorsement is the first, write it about two inches from the top of the back; if it is not the first indorsement, write immediately under the last indorsement.

- Do not indorse wrong end up; the top of the back is the left end of the face.

- Write your name as you are accustomed to write it, no matter how it is written on the face. If you are depositing the cheque write or stamp "For Deposit" or "Pay to ______Bank______," as may be the custom, over your signature. This is hardly necessary if you are taking the cheque yourself to the bank. A cheque with a simple or blank indorsement on the back is payable to bearer, and if lost the finder might succeed in collecting it; but if the words "For Deposit" appear over the name the bank officials understand that the cheque is intended to be deposited, and they will not cash it.

- If you wish to make the cheque payable to some particular person by indorsing, write "Pay to ______(name)______ or order," and under this write your own name as you are accustomed to sign it.

- Do not carry around indorsed cheques loosely. Such cheques are payable to bearer and may be collected by any one.

- [11]If you receive a cheque which has been transferred to you by a blank indorsement (name of indorser only), and you wish to hold it a day or two, write over the indorsement the words "Pay to the order of (yourself—writing your own name)." This is allowable legally. The cheque cannot then be collected until you indorse it.

- [12]An authorised stamped indorsement is as good as a written one. Whether such indorsements are accepted or not depends upon the regulations of the clearing-house in the particular city in which they are offered for deposit. The written indorsement is considered safer for transmission of out-of-town collections.

- If you are indorsing for a company, or society, or corporation, write first the name of the company (this may be stamped on) and then your own name, followed by the word "Treas."

- If you have power of attorney to indorse for some particular person, write his name, followed by your own, followed by the word "Attorney" or "Atty.," as it is usually written.

- It is sometimes permissible to indorse the payee's name thus, "By ______(your own name)." This may be done by a junior member of a concern when the person authorised to indorse cheques is absent and the cheques are deposited and not cashed.

- Do not write any unnecessary information on the back of your cheque. A story is told of a woman who received a cheque from her husband, and when cashing it wrote "Your loving wife" above her name on the back.

V. BANK CHEQUES (Continued)

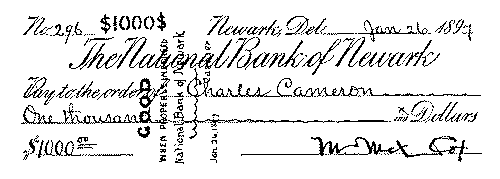

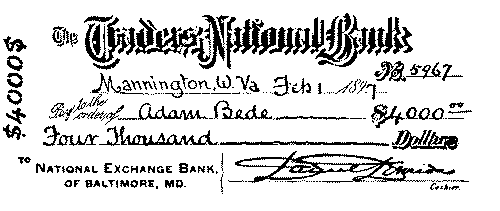

If you wish to draw money from your own account, the most approved form of cheque is written "Pay to the order of Cash." This differs from a cheque drawn to "Bearer." The paying teller expects to see yourself, or some one well known to him as your representative, when you write "Cash." If you write "Pay to the order of[13] (your own name)" you will be required to indorse your cheque before you can get it cashed.

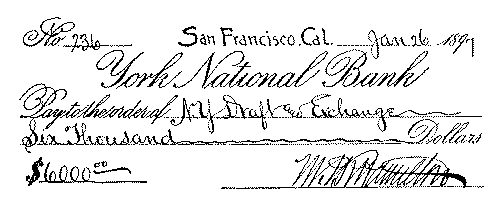

If your note is due at your own bank and you wish to draw a cheque in payment, write "Pay to the order of Bills Payable." If you wish to write a cheque to draw money for wages, write "Pay to the order of Pay-roll." If you wish to write a cheque to pay for a draft which you are buying, write "Pay to the order of N. Y. Draft and Exchange," or whatever the circumstances may call for.

If you wish to stop the payment of a cheque which you have issued you should notify the bank at once, giving full particulars.

Banks have a custom, after paying and charging cheques, of cancelling them by punching or making some cut through their face. These cancelled cheques are returned to the makers at the end of each month.

If you have deposited a cheque and it is returned through your bank marked "No Funds," it signifies that the cheque is worthless and that the person upon whose account it was drawn has no funds to meet it. Your bank will charge the amount to your account. The best thing to[14] do in such a case is to hold the cheque as evidence of the debt, and write the person who sent it to you, giving particulars and asking for an explanation.

If you wish to use your cheque to pay a note due at some other bank, or in buying real estate, or stocks, or bonds, you may find it necessary to get the cheque certified. This is done by an officer of the bank, who writes or stamps across the face of the cheque the words "Certified" or "Good When Properly Indorsed," and signs his name. (See illustration.) The amount will immediately be deducted from your account, and the bank, by guaranteeing your cheque, becomes responsible for its payment. Banks will usually certify any cheque drawn upon them if the depositor has the amount called for to his credit, no matter who presents the cheque, and this certifying makes it feasible for a man to carry in his pocket any amount of actual cash. If you should get a cheque certified and then not use it, deposit it in your bank, otherwise your account will be short the amount for which the cheque is drawn. In Canada all cheques are presented to the "ledger-keeper" for certification before being presented to the paying teller.

[15]THE USEFULNESS OF BANKS

Banks are absolutely necessary to the success of modern commercial enterprises. They provide a place for the safe-keeping of money and securities, and they make the payment of bills much more convenient than if currency instead of cheques were the more largely used. But the great advantage of a banking institution to a business man is the opportunity it affords him of borrowing money, of securing cash for the carrying on of his business while his own capital is locked up in merchandise or in the hands of his debtors. Another important advantage is to be found in the facilities afforded by banks for the collection of cheques, notes, and drafts.

VI. BANK DRAFTS

A draft is a formal demand for the payment of money. Your bank cheque is your sight draft on your bank. It is not so stated, but it is so understood. A cheque differs from an ordinary commercial draft, both in its wording and in its purpose. The bank is obliged to pay your cheque if it holds funds of yours sufficient to meet it, while the person upon whom your draft is drawn may or may not honour it at his pleasure. A cheque is used for paying money to a creditor, while a draft is used as a means of collecting money from a debtor.

Nearly all large banks keep money on deposit with one or more of the banks located in the great commercial centres. They call these centrally located banks their correspondents. The larger banks have correspondents in New York, Chicago, Boston, and other large cities.[16] As business men keep money on deposit with banks to meet their cheques, so banks keep money on deposit with other banks to meet their drafts.

A bank draft is simply the bank's cheque, drawn upon its deposit with some other bank. Banks sell these cheques to their customers, and merchants make large use of them in paying bills in distant cities. These drafts, or cashiers' cheques, as they are sometimes called, pass as cash anywhere within a reasonable distance of the money centre upon which they are drawn. Bankers' drafts on New York would, under ordinary financial conditions, be considered cash anywhere in the United States. A draft on a foreign bank is usually called a bill of exchange.

Cheques have come to be quite generally used for the payment of bills even at long distances. If a business man desires to close an important contract requiring cash in advance he sends a bank draft, if at a distance, or a certified cheque, if in the same city. If he desires simply to pay a debt he sends his own personal cheque. Bank drafts are quite generally used by merchants in the West to pay bills in the East. A draft on New York[17] bought in San Francisco is cash when it reaches New York, while a San Francisco cheque is not cash until it returns and is cashed by the bank upon which it is drawn. In the ordinary course of business cheques are considered cash no matter upon what bank drawn. The bank receiving them on deposit gives the depositor credit at once, even though it may take a week before the value represented by the cheque is in the possession of the bank.

All wholesale transactions and a large proportion of retail transactions are completed by the passing of instruments of credit—notes, cheques, drafts, etc.; a part only of the retail trade is conducted by actual currency-bills and "change." Banks handle the bulk of these transferable titles and deal to a very small extent—that is, proportionally—in actual money. The notes, drafts, bills of exchange, and bank cheques are representative of the property passing by title in money from the producers to the consumers. A small proportion—perhaps six or eight per cent.—of these transactions is conducted by the use of actual bank or legal-tender notes. This trade in[18] instruments of credit amounts in the United States to fifty billions of dollars yearly.

VII. PROMISSORY NOTES

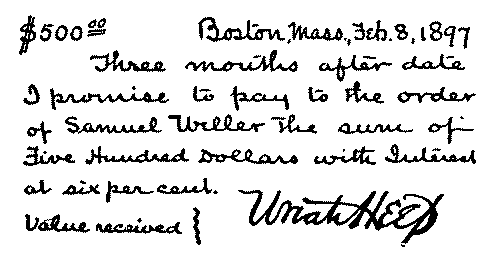

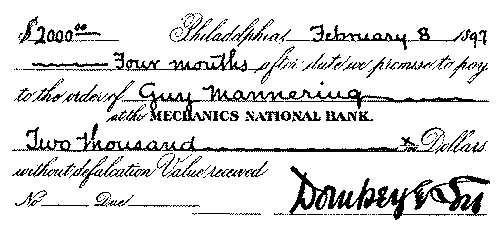

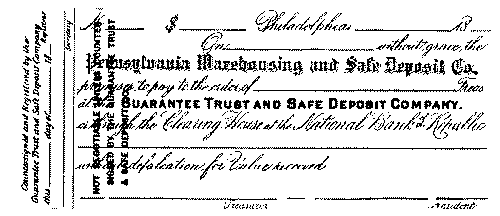

A promissory note is a written promise to pay a specified sum of money. At the time of the note's issue—that is, when signed and delivered—two parties are connected with it, the maker and the payee. The maker is the person who signs or promises to pay the note; the payee is the person to whom or to whose order the note is made payable. Negotiable in a commercial sense means transferable, and a negotiable note is a note which can be transferred from one person to another. A note to be made negotiable must contain the word bearer or the word order—that is, it must be payable either to bearer, or to the order of the payee. A non-negotiable note is payable to a particular person only. A note may be written on any[19] kind of paper, in ink or pencil. It is wise, however, to use ink to prevent changes. All stationers sell blank forms for notes which are easily filled in.

The samples of notes which appear in this lesson are selected simply to illustrate to students the fact that there are a great many special forms of notes in common use. The wording differs slightly in different States.

The date of a note is a matter of the first importance. Some bankers and business men consider it better to draw notes payable at a certain fixed time, as, "I promise to pay on the 10th of March, 1897." The common custom is to make notes payable a certain number of days or months after date. A note made or issued on Sunday is void. The day of maturity is the day upon which a note becomes legally due. In several of the States a note is not legally due until three days, called days of grace, after the expiration of the time specified in the note.

The words value received, which usually appear upon notes, are not necessary legally. Thousands of good notes made without any value consideration are handled daily.

[20]The promise to pay of a negotiable note must be unconditional. It cannot be made to depend upon any contingency whatever.

Notes that are made in settlement of genuine business transactions come under the head of regular, legitimate business paper. An accommodation note is one which is signed, or indorsed, simply as an accommodation, and not in settlement of an account or in payment of an indebtedness. With banks accommodation paper has a deservedly hard reputation. However, there are all grades and shades of accommodation paper, though it represents no actual business transaction between the parties to it, and rests upon no other foundation than that of mutual agreement. No contract is good without a consideration, but this is only true between the original parties to a note. The third party or innocent receiver or holder of a note has a good title, and can recover its value, even though it was originally given without a valuable consideration. An innocent holder of a note which had been originally lost or stolen has a good title to it if he received it for value.

[21]A note does not draw interest until after maturity, unless the words with interest appear on the face. Notes draw interest after maturity and until paid, at the legal rate.

A note should be presented for payment upon the exact day of maturity. Notes made payable at a bank, or at any other place, must be presented for payment at the place named. When no place is specified the note is payable at the maker's place of business or at his residence.

In finding the date of maturity it is important to remember that when a note is drawn days after date the actual days must be counted, and when drawn months after date the time is reckoned by months.

To discount a note is to sell it at a discount. The rates of discount vary according to the security offered, or the character of the loan, or the state of the money market. For ordinary commercial paper the rates run from four to eight per cent. Notes received and given by commercial houses and discounted by banks are not usually for a longer period than four months.

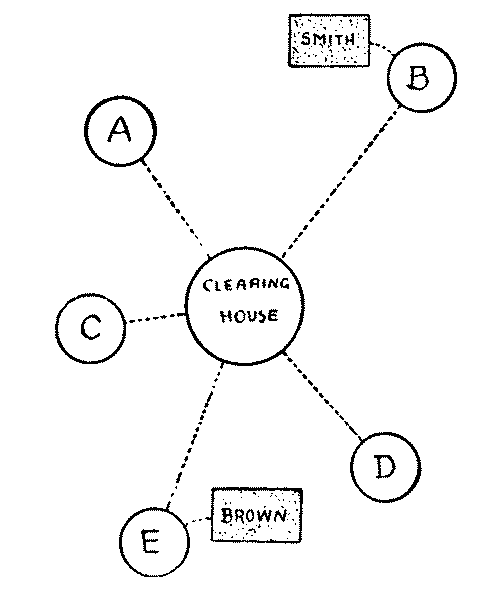

VIII. THE CLEARING-HOUSE SYSTEM

In large cities cheques representing millions of dollars are deposited in the banks every day. The separate collection of these would be almost impossible were it not for the clearing-house system. Each large city has its clearing-house. It is an establishment formed by the banks themselves, and for their own convenience. The leading banks of a city connect themselves with the clearing-house of that city, and through other banks with the clearing-houses of other cities, particularly New York. Country banks connect themselves with one or more clearing-houses through city banks, which do their[22] business for them. The New York banks, largely through private bankers, branches of foreign banking houses, connect themselves with London, so that each bank in the world is connected indirectly with every other bank in the world, and in London is the final clearing-house of the world.

Suppose that the above diagram represents the banks and clearing-house of a city, and also the two business houses of Brown and Smith. Brown keeps his money on deposit in Bank E, and Smith in Bank B. Brown sends (by mail) a cheque to Smith in payment of a bill. Now, Smith can come all the way to Bank E, and, if he is properly identified, can collect the cheque. He does not do this, however, but deposits Brown's cheque in[23] Bank B, the bank where he does his banking business. Now, B cannot send to E to get the money. It could do this, perhaps, if it had only one cheque, but it has taken in hundreds of cheques, some, perhaps, on every bank in town, and on many banks out of town. It would take a hundred messengers to collect them. So, instead of B's going to E, they meet half-way, or at a central point called a clearing-house, and there collect their cheques. B may have $5000 in cheques on E, and E may have $4000 in cheques on B, so that the exchange can be made—that is, the cheques can be paid by E paying the difference of $1000, which is done, not direct, but through the officers of the clearing-house. Now Bank E's messenger carries Brown's cheque back with him and enters it up against Brown's account. This in simple language is the primary idea of the clearing-house.

The clearings in New York in one day amount to from one to two hundred millions of dollars. By clearings we mean the value of the cheques which are cleared—that is, which change hands through the clearing-house. Usually once a week (in some cities oftener) the banks of a city make to their clearing-house a report, based on daily balances, of their condition.

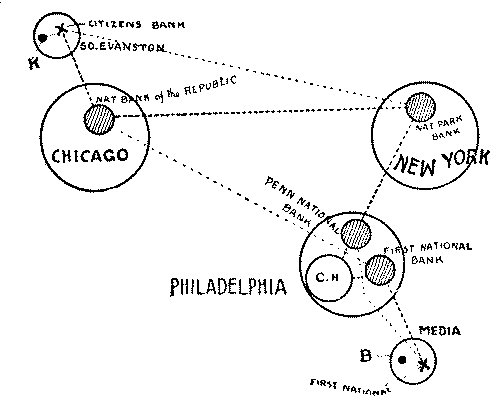

To illustrate the connection between banks at distant points let us suppose that B of Media, Pennsylvania, who keeps his money on deposit in the First National Bank of Media, sends a cheque in payment of a bill to K of South Evanston, Illinois. K deposits the cheque in the Citizens Bank of his town and receives immediate credit for it upon his bank-book, just the same as though the cheque were drawn upon the same or a near-by bank. The Citizens Bank simply sends the cheque, with other distant cheques, to its correspondent, the National Bank of the Republic, Chicago, on deposit, in many instances in about the same sense that K deposited the cheque in the Citizens Bank. The National Bank of the Republic sends the cheque, with other cheques, to its New York correspondent, the National Park Bank. It may possibly send to Philadelphia direct, or even to Media; but this is very unlikely. The National Park Bank sends the cheque to its Philadelphia correspondent, say the Penn National Bank. Now the clearing-house clerk of the Penn National carries the cheque to the Philadelphia clearing-house and enters it, with other cheques, on the First National of Media. Custom, however, differs very greatly in this particular. Many near-by country banks clear through city banks; others clear less directly. If the First National Bank of Philadelphia is known at the clearing-house as the representative of the First National Bank of Media it likely has money belonging to this Media bank on deposit. In that case the cheque is charged up against the account of the First National of Philadelphia. This bank then sends the cheque to the First National of Media, by which it is charged up against B. This system of collection of cheques is about as perfect as is the post-office system of carrying registered mail.

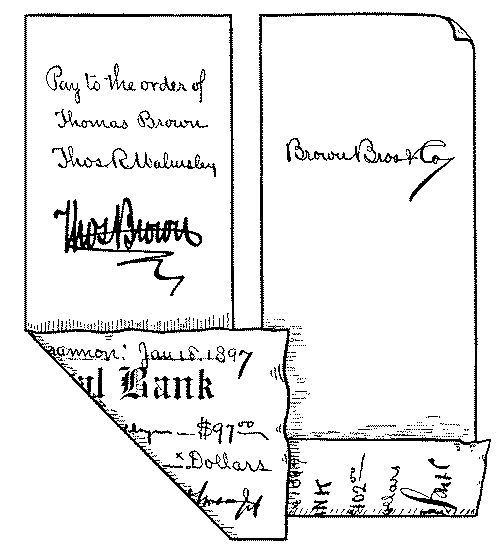

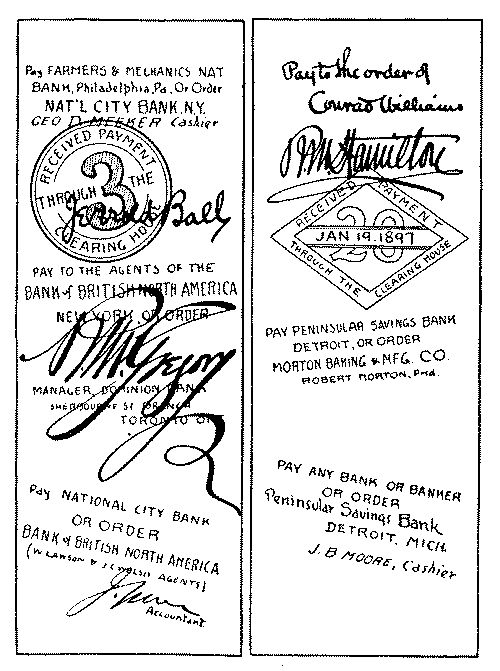

[26]Now, the banks and clearing-houses through which the cheque passes on its way home stamp their indorsements and other information upon the back. Our illustration shows the backs of two cheques which have "travelled." Millions of dollars are collected by banks daily in this way, and all without expense to their customers. It is estimated that these collections cost the New York City banks more than two million dollars a year in loss of interest while the cheques are en route. Ten thousand collection letters are sent out daily by the banks of New York City alone.

IX. COMMERCIAL DRAFTS

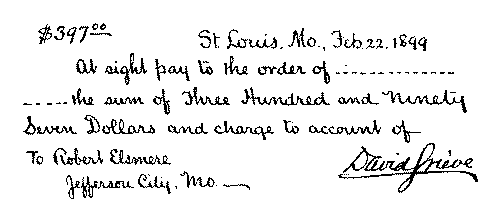

A commercial draft bears a close resemblance to a letter from one person to another requesting that a certain sum of money be paid to the person who calls, or to the bank or firm for whom he is acting. For instance, the draft shown in the first illustration might be worded something like this:[27]

St. Louis, Mo., Feb. 22, 1899.

Mr. Robert Elsmere,

Jefferson City, Mo.

My dear Sir:

Will you kindly pay to the messenger from the —— Bank who will call to-morrow the sum of three hundred and ninety-seven dollars and charge to my account?

Yours, very truly,

David Grieve.

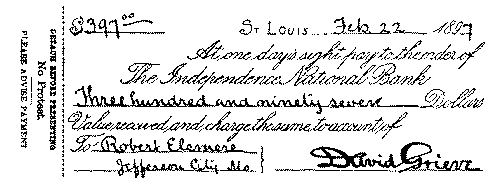

Commercial usage, however, recognises a particular form in which this letter is to be written, and the address of the person for whom it is intended is usually written at the lower left-hand corner instead of on an envelope. Commercial drafts usually reach the persons upon whom they are drawn through the medium of the banks rather than directly by mail. Let us illustrate. Suppose that A of Chicago owes B of Buffalo $200, and B desires to collect the amount by means of a draft. He fills in a blank draft, signs it, and addresses it on the[28] lower left-hand corner to A. Instead of sending it by mail he takes it to his bank—that is, deposits it for collection. It will reach a Chicago bank in about the same way that cheques for collection go from one place to another. A messenger from the Chicago bank will carry the draft to A's office and present it for payment or for acceptance. If it is a sight draft—that is, a draft payable when A sees it—he may give cash for it at once and take the draft as his receipt. If he has not the money convenient he may write across the face "Accepted, payable at (his) Bank," as in the illustration. It will then reach his bank and be paid as his personal cheque would be, and should be entered in his cheque-book. Banks usually give one day upon sight drafts. The draft will not be presented a second time, but will be held at the bank until the close of the banking hours the next day, where A can call to pay if he chooses. Leniency in the matter of time will depend largely upon B's instructions and the bank's attitude toward A. If the draft is a time draft—that is, if B gives A time, a certain number of days, in which to pay it—A, if he wishes to pay the draft, accepts it. He does this by writing the word accepted with the date and his signature across the face of the draft. He may make it payable at his bank as he would a note, if he so desires. He then returns the draft to the messenger, and if the time is long the draft is returned to B; if only a few days, the bank holds it for collection.

[30]An accepted draft is really a promissory note, though it is more often called an acceptance. When a man pays or accepts a draft he is said to honour it. In the foregoing illustration A is not obliged either to pay or to accept the draft. It is not binding upon him any more than a letter would be. He can refuse payment just as easily and as readily as he could decline to pay a collector who calls for payment of a bill. Of course, if a man habitually refuses to honour legitimate drafts it may injure his credit with banks and business houses.

It is a very common thing to collect distant accounts by means of commercial drafts. A debtor is more likely to meet—that is, to pay—a draft than he is to reply to a letter and inclose his cheque. It is really more convenient, and safer, too, for there is some risk in sending personal cheques through the mail. There are some houses that make all their payments by cheques, while there are others which prefer to have their creditors at a distance draw on them for the amounts due.

If a business man who has been accustomed to honour drafts continues for a period to dishonour them, the banks through which the drafts pass naturally conclude that he is unable to meet his liabilities.

Some houses deposit their drafts for collection in their[31] home banks, while others have a custom of sending them direct to some bank in or near the place where the debtor resides. If the place is a very small one the collection is sometimes made through one of the express companies.

When goods are sold for distinct periods of credit, and it is generally understood that maturing accounts are subject to sight drafts, there should be no need of notifying the debtor in advance. Some houses, however, make a general custom of sending notices ten days in advance, stating that a draft will be drawn if cheque is not received in the meantime.

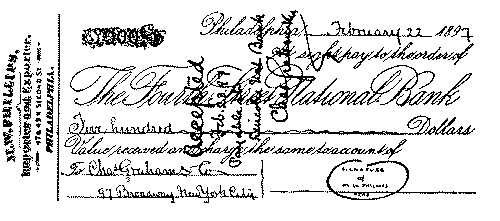

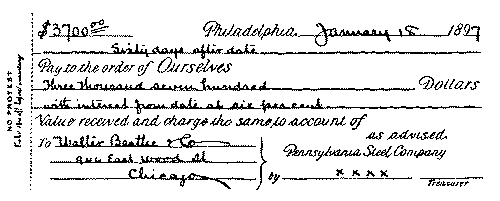

Notice the illustrations. The protest notice at the left of Nos. 1, 2, and 4 is intended for the bank presenting the draft for payment. The reason for this will be fully explained in our lesson on protested paper. (See Lesson XIII.) No. 2 shows an accepted draft payable to the order of a bank in the city upon which it is drawn. No. 1 is payable to the order of a bank in the city of the drawer. No. 3 is a sight draft payable to the order of a bank and accepted payable at a bank. No. 4 is a time draft payable to "ourselves"—that is, the Pennsylvania Steel Company.

Drafts are often discounted at banks before acceptance where the credit of the drawer is good. In such cases the drafts which are dishonoured are charged up against the drawer's account.

X. FOREIGN EXCHANGE

It is quite in order that we should follow lessons on the clearing-house and commercial drafts with a lesson on foreign exchange.

We learned in the last lesson that commercial drafts are made use of to facilitate the collection of accounts.[32] They are simply formal demands for the payment of legitimate debts. When these formal demands are made upon foreign debtors they are called bills of exchange; and the process of buying and selling these drafts, the drafts themselves, and the fluctuations in price, all are included in the general name exchange.

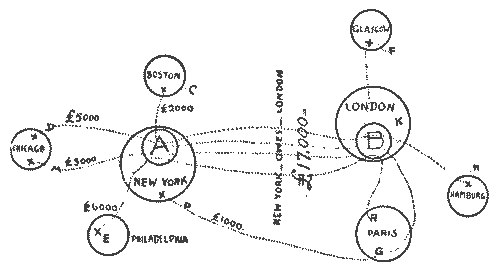

To illustrate the principles of exchange let us suppose that the following transactions have occurred:

- C of Boston has sold goods, £2000, to H of Hamburg.

- D of Chicago has sold goods, £5000, to F of Glasgow.

- M of Chicago has sold goods, £3000, to K of London.

- E of Philadelphia has sold goods, £6000, to R of Paris.

- P of New York has sold goods, £1000, to G of Paris.

C draws on H for £2000, sells the draft to a banking-house in Boston; they send to Bank A of New York, and[33] the New York bank to their London correspondent, say Bank B, with instructions to collect from Hamburg.

D draws in a similar way on F. E draws on R, and P on G. Suppose that M instead of drawing on K receives a draft drawn by Bank B of London on Bank A of New York, payable to M's order.

America has sold goods worth £17,000 to Europe.

Europe . . . . . . owes £17,000 to . . . . . America

But B has paid A £3000.

____________

B . . . . . . therefore owes £14,000 to . . . . . . A

Now it will cost B a considerable sum of money to ship £14,000 in gold to A, for all exchanges between Europe and America are payable in gold. Suppose that S of New York owes T of London £14,000, and T draws on S and takes the draft to Bank B in London and offers it for sale. Will B offer more or less than £14,000 for the bill of exchange or draft? He will offer more. It will be cheaper for him to pay a premium for the draft than to ship gold, for he can send this draft to Bank A to pay his indebtedness, and A can collect from S.

In the money market in New York there is a constant supply of exchanges (drafts) on London, and in London a constant supply of exchanges on New York.

Experience has shown that at all times the number of persons in Europe indebted to American business houses is about (though of course not actually) the same as the number of persons in America indebted to European houses. Hence when A of New York wishes to make a payment to B of London he does not send the actual money, but goes into the market—that is, to a banker doing a foreign business—and buys a draft, called a bill of exchange, which is in reality the banker's order on his London correspondent, asking the latter to pay the money to the person named. It may be that[34] about the same time some London merchant who owes money in New York goes to the very same London banker and buys a draft on the New York bank. In this way the one draft cancels the other, and when there is a difference at the end of the week or month the actual gold is sent across to balance the account.

These exchanges have a sort of commodity value, and like all commodities, depend upon the law of supply and demand. When gold is being shipped abroad we say that the balance of trade is against us—that is, we are buying more from Europe than Europe is buying from us, and the gold is shipped to pay the balance or difference.

The par of the currency of any two countries means, among merchants, the equivalency of a certain amount of the (coin) currency of the one in the (coin) currency of the other, supposing the currencies of both to be of the precise weight and purity fixed by the respective mints. The par of exchange between Great Britain and the United States is 4.862⁄3; that is, £1 sterling is worth $4.862⁄3. Exchange is quoted daily in New York and other city papers at 4.87, 4.88, 4.88½, etc., for sight bills and at a higher rate for sixty-day bills. Business men who are accustomed to watching fluctuations in exchange rates use the quotations as a sort of barometer to foretell trade conditions. The imports and exports of bullion (uncoined gold) are the real test of exchange. If bullion is stationary, flowing neither into nor out of a country, its exchanges may be truly said to be at par; and on the other hand, if bullion is being exported from a country, it is a proof that the exchange is against it; and conversely if there be large importations.

The cost of conveying bullion from one country to another forms the limit within which the rise and fall of the real exchange between them must be confined. If, for illustration, a New York merchant owes a debt in[35] London and exchange costs him, say, two per cent., and the cost of shipping the gold is only one per cent., it will be to his advantage to pay the debt by sending the actual coin across. A favourable real exchange operates as a duty on exportation and as a bounty on importation.

It is to the interest of merchants or bankers who deal[36] in foreign bills to buy them where they are the cheapest and to sell them where they are the dearest. For this reason it might often be an advantage for a New York merchant to buy a bill on London to pay a debt in Paris.

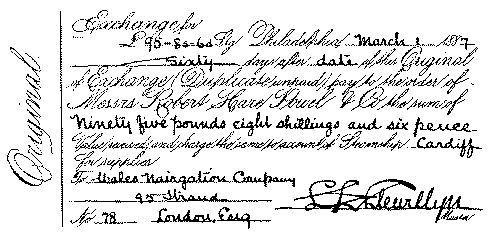

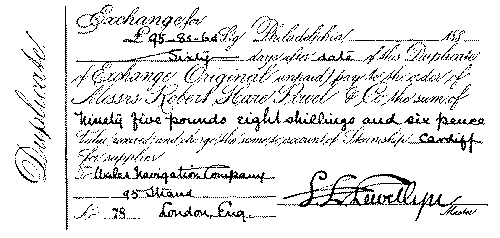

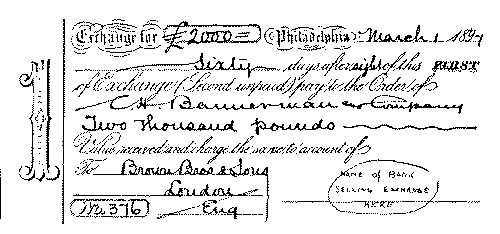

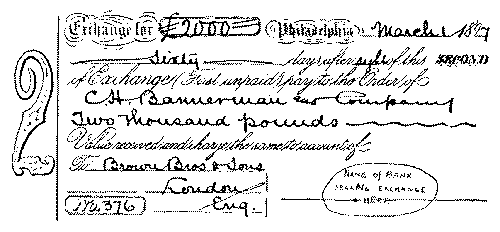

Two illustrations of bills of exchange are given in this lesson. Each is drawn in duplicate. The original is sold[37] or sent abroad, while the duplicate is preserved as a safeguard against the loss of the original. When one is paid the other is of no value. Notice the similarity between bills of exchange as shown here and commercial drafts as shown in our last lesson.

The first form shows a draft made by a coal company upon a steamship company to pay for coal supplied to a particular steamer. Suppose that the steamship company has a contract with Robert Hare Powel & Co. of Philadelphia to supply coal to their steamers. The steamer Cardiff, when in port at Philadelphia, is supplied; the bill is certified to by the engineer; the master (captain) of the vessel signs Powel & Co.'s draft (and in doing this really makes it the captain's draft); the bill is receipted. Now Powel & Co. sell this exchange (draft) on London to a broker or banker doing a foreign business. It is forwarded to London and presented in due time at the office of the Wales Navigation Company for payment.

The second form shows a bill of exchange drawn by a Philadelphia banking house upon a London banking house and payable to the order of the firm buying the draft. C. H. Bannerman & Co. will send this bill (the original) to pay an account in Europe. The first form bears the same relation to a commercial draft that the second does to a cashier's cheque.

XI. LETTERS OF CREDIT

The usual instruments of credit by means of which travellers abroad draw upon their deposits at home are known as circular letters of credit. These forms of credit are of such common use that every one should be familiar with their form. We reproduce here a facsimile[39] of the first and second pages of a circular letter for £1000, copied with slight change of names from an actual instrument. The first page shows the credit proper authorising the various correspondents of the bank issuing it to pay the holder, whose signature is given on its face, money to the extent of £1000. The names of the banks who are authorised to advance money upon the letter are usually printed upon the third and fourth pages, though letters issued by well-known banking houses are usually recognised by any banking house to which they are presented.

The second illustration shows how the holder of a particular letter availed himself of its advantages. It gives the names of the banks to which he presented his letter, and the amounts paid by each.

With such a letter a traveller could make a trip around the world and not have in his pocket at any one time more gold or silver or bills than would be necessary to meet immediate expenses.

Suppose that A. B. is about to make a European trip. He goes to a bank doing a foreign business, say Brown Bros. & Co. of New York City, and asks for a circular letter for £1000, for which he is obliged to pay about $4880. Copies of A. B.'s signature are left with Brown Bros. & Co., and may perhaps be forwarded to their foreign banking houses. When A. B. presents himself at a Glasgow or Paris bank with his letter of credit, and asks for a payment upon it, the banker asks him to sign a draft on Brown Bros. & Co., New York, or more likely on their London bank, for the amount required, which amount is immediately indorsed on the second page of the letter of credit, so that when the indorsements equal the face the letter is fully paid. A. B. is simply drawing upon his own account—that is, upon the money he deposited to secure the letter of credit.

[40]Payment is usually made upon the simple identification or comparison of signatures. If a traveller should lose his letter of credit he should notify at once the bank issuing it and, if possible, the banks upon which drawn.

There are several other forms of travellers' credits in use. The Cheque Bank, an English institution with a branch in New York City, issues to travellers a book of cheques, each of which can be filled up only to a limited[41] amount, as shown by printed and perforated notices appearing on the face. For instance, for £100 one can buy a cheque-book containing fifty blank cheques, each good, when properly filled up, for £2. Each of these cheques is really a certified cheque, only it is certified in advance of issue. Any of the thousand or more foreign banks which are agents for the Cheque Bank sell these cheque-books, and cash the cheques when presented. The amounts that may be short drawn go toward the cost of a new cheque-book, or may be returned in cash. The American and other express companies have forms of travellers' cheque-books very similar to those issued by the Cheque Bank.

XII. JOINT-STOCK COMPANIES

To organise a stock company it is necessary for a number of persons to come together and make a certificate to the effect that they propose to form a company to bear a certain name, for the purpose of transacting a certain kind of business at a certain place. The certificate states that they propose to issue a certain number of shares of stock at a certain price per share, that the capital stock is to be a certain amount, and that the company is to continue to exist for a definite period of time. Blank forms for such certificate are supplied by the Secretary of the State where the company is being organised, and when such certificate is properly filled out, signed, and delivered to him, he issues a license, or charter, to the persons making such certificate, giving them permission to open books, sell stock, and carry on the enterprise outlined.

State laws regarding stock companies differ very largely. Students of this course who desire to know the law in any particular State can easily secure the information by writing to the secretary of that State.

[42]The usual par value of a share of stock is $100. That is, if a company organises with a capital of $200,000, there will be 2000 shares to sell. Each person who buys or subscribes for the stock—that is, who joins the company—receives a certificate of stock. Our illustrations show two examples; one of a national bank, and the other of a manufacturing company. These certificates are transferable at the pleasure of the owners. The transfer is made usually by a form of indorsement on the back of the certificate, but to be legal the transfer must be recorded on the books of the company.

The men subscribing in this way become responsible[43] for the good management of the business and are obliged to act according to the laws of the State in which the company is organised. Usually they are not responsible individually for the liabilities of the concern beyond the amounts of their individual subscriptions.

Every person who subscribes for stock owns a part of the business and is called a shareholder. All the shareholders meet together, and out of their number they choose a certain number of directors. The directors choose a president and other necessary officers, and in a general way direct the policy of the company. As a rule directors have no salaries attached to their positions.[44] General meetings of shareholders are held once a year to elect the directors and to hear the reports of the officers.

The student should be familiar in a general way with the different classes of stock and with the technical terms familiar to stock companies. The more important of these matters are as follows:

Directors. All the shareholders meet together and out of their number choose a certain number of directors. The directors choose a president and other necessary officers and fix the amount of salary which shall be paid such officers for their work.

Capital Stock. This name is given to the gross capital for which the company is organised, without any reference to its value or to whether it has been fully paid in or not. The paid-in capital is the amount received from the stockholders on the shares for which they have subscribed.

Dividends. The directors of the company, after paying the expenses and laying by a certain amount for contingencies, divide the profits among the shareholders. These profits are called dividends, and in successful concerns such dividends as are declared quarterly, semiannually, or annually usually amount to good interest on the shareholders' investments.

Treasury Stock. It often occurs that a new company finds it necessary to set aside a certain number of shares to be sold from time to time to secure working capital. Such stock is held in the treasury until it is needed, and is called treasury stock.

Preferred Stock. Preferred stock is stock which is guaranteed certain advantages over ordinary stock. It is usually given to secure some obligation of the company, and upon it dividends are declared in preference to common stock. That is to say, if a man holds a share of preferred stock he will receive interest thereon out[45] of the profits of the business before such profits are given in the form of dividends to shareholders generally. Preferred stock can be issued only when authorised by the charter of the company. The interest on the investment in the case of preferred stock is more sure, but the security itself is not any more secure than in the case of common stock.

Guaranteed Stock. Guaranteed stock differs from preferred stock in this—that it is entitled to the guaranteed dividend (interest) before all other classes of stock, whether the company earns the necessary amount in any one year or not. This right is carried over from year to year, thus rendering the shares absolutely secured as to interest.

Watered Stock. When stock is issued to the shareholders without increase of actual capital the stock is said to have been watered. A company may organise for, say, $10,000, and may want to increase to $50,000 without adding to the number of its shareholders. Each holder of one share will, in this instance, receive four new shares, and in future instead of receiving a dividend on one share will receive a dividend on five shares. The object of this is, quite commonly, to avoid State laws requiring certain corporations to pay excess of profit over a stated rate per cent. into the State treasury.

Forfeited Stock. Stock is usually sold on certain explicit conditions, such as the paying of ten per cent. down and the balance in installments at stated intervals. If the conditions which are agreed to by the shareholder are not met his stock is declared forfeited, or he can be sued in the same manner as upon any other contract.

Assessments. Some companies organise with the understanding that a certain percentage of the nominal value of the shares is to be paid at the time of subscribing, and that future payments are to be made at such times and[46] in such amounts as the company may require. Under these conditions the stockholders are assessed whenever money is needed. Such assessments are uniform on all stockholders.

Surplus Fund. It is not customary to pay a larger dividend than good interest. The profits remaining after the expenses and dividends are paid are credited to what is called a surplus fund. This fund is the property of the shareholders and is usually invested in good securities.

Franchise. A franchise is a right granted by the State to individuals or to corporations. The franchise of a railroad company is the right to operate its road. Such franchise has a value entirely distinct from the value of the plant or of the ordinary property of the corporation.

Sinking Fund. A sinking fund is a fund set aside yearly for the purpose at some future time of sinking—that is, paying a debt.

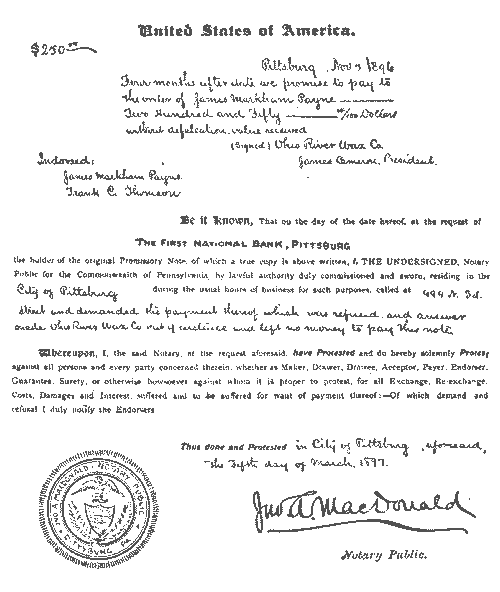

XIII. PROTESTED PAPER

When a note is presented for payment at maturity and is not paid it is usually protested; that is, a notary public makes a formal statement that the note was presented for payment and payment was refused. Notice of such protest is sent to the maker of the note and to each indorser.

The bank should never hand to its notary any paper for protest until it has made sure that its non-payment has not been brought about by some error or misunderstanding. Quite often, even though the paper has been made payable at a bank, the notary sends a messenger with the note to the maker to make a formal demand for payment.

In taking in collection paper, banks should obtain clear instructions from its owners as to whether or not it should[47] be protested in case of non-payment. It by no means follows that a formal protest is not desired because the paper bears no indorsements. Many banks make it a rule to protest all unpaid paper unless otherwise ordered.

We often see attached to the end of a draft a little slip with the words: "No protest; tear this off before protesting." This is simply private advice to the banker informing him that the drawer does not wish to have the draft protested. It may be that he does not wish to wrong or injure the credit of or add to the expense of his debtor; or it may be that he considers the account doubtful and does not wish to add to his own loss the cost of protest fees.

To hold an indorser, he must be properly notified of the non-payment of the note; and whether this has been done is a question of fact. If he was not properly notified this defence will avail whenever it is clearly proved. A great variety of defences may be successfully made by an indorser. A few of these defences are here briefly noticed: One is usury; another is the maker's discharge by the holder; nor can he be held when he has paid the note; nor when its issue was unlawful, nor when the note was non-negotiable, nor when his indorsement was procured by fraud. Finally, an indorser may avail himself of any defence existing between the holder and the maker or principal debtor. This is evidently a just principle, for the holder should have no more rights against an indorser than he has against the maker. If, therefore, the maker can interpose some just claim as a partial or complete defence the indorser should be permitted to avail himself of this claim.

In order to recover from an indorser it must be proven that a formal and proper demand for payment was made upon the maker. The formal protest is usually undisputed evidence of this. The maker is liable in any event.

[49]To make the indorser's liability absolute it is necessary to demand payment at the specified place on the last day of the period for which the note was given, and to give due notice of non-payment to the indorser. For, as the contract requires the maker to pay at maturity, the indorser may presume, unless he has received a notice to the contrary, that the maker has paid the obligation.

Ordinarily a notice of an indorsement by a partnership need not be sent to each member. Even after the partnership has been dissolved a notice to one partner is sufficient to bind the other members. If the note is owned jointly (that is, by parties who are not business partners) the indorsers are not liable as partners but as individuals. In such a case the notice of non-payment should be sent to each.

Our illustration shows a facsimile of a protest notice.

XIV. PAPER OFFERED FOR DISCOUNT

One of the most valuable parts of a banker's education is to learn whom to trust. Every bank should have a well-organised and thoroughly equipped credit department, in charge of some one who can be relied upon to investigate carefully all names referred to him by the officers. A banker has the right to expect the fullest confidence on the part of the borrower, and the borrower should furnish him with a complete and detailed statement of the condition of his affairs. It is safe to conclude that when a borrower refuses absolutely to give any information as to his financial condition his credit is not in the most favourable shape.

Many of the banks have blank forms which they, from time to time, ask borrowers to fill out. These statements show in detail the assets and liabilities of the firm in[50] question; they show the notes which are outstanding, the mortgages on real estate, and many other particulars, including the personal or individual credit of members of the firm, if a partnership.

In estimating the value of paper offered for discount the following points should be considered:

- The total net worth of the borrower.

- The character of his business; whether it is speculative or staple.

- The borrower's record and standing in the community and his business habits.

- Whether he is in enterprise abreast with modern ideas and methods.

- The character of the merchandise owned by the borrower. What would it bring under the hammer? Groceries and raw material can usually be turned into cash at a forced sale at very small discount from current prices. Not so with hardware, glass, dry goods, boots and shoes, books, etc. Machinery and fixtures are not a bankable asset upon which to base credit.

The banker should note his borrower's bills payable. Why did he give notes? Are they met promptly? Many houses prefer to sell their own paper in the open market, and keep their banks open for accommodations when they are unable to secure outside credit. The insurance carried should be considered; also the volume of business done. A large business on moderate capital, with long credits, will naturally have large liabilities, while a small business with a liberal capital and short credits should have small liabilities.

Paper offered for discount is of a variety of kinds. The larger proportion of it is from customers of the borrower who have extended their credit by paying their accounts in notes instead of in cash. Such paper is really, though having two names, very little better than[51] single-name paper, for it is not the maker's credit, but the payee's, which the bank usually considers. Many very small notes offered for discount usually indicate a very needy condition.

There are many firms which carry two or more bank accounts, and others who sell their paper to out-of-town banks. In buying paper it is important to ascertain whether the firm is in the habit of taking up paper at one bank by floating a loan at another.

Paper may be classified for purposes of discount as follows:

- Bills drawn by shippers on the houses to which the goods are shipped.

- Bills drawn by importers against commodities placed in brokers' hands for sale.

- Bills arising out of our manifold trades and industries.

- Drafts with bills of lading attached.

- Paper having personal indorsements.

- Paper secured by collateral.

- One-name paper.

XV. CORPORATIONS

Stock companies are in a sense corporations, but the name corporation has in its common application a broader meaning. Public corporations are those which are created exclusively for the public interest, as cities, towns, counties, colleges, etc. Private corporations are created wholly or in part for the pecuniary benefit of the members, as railroad companies, banks, etc. Corporate bodies whose members at discretion fill by appointment all vacancies occurring in their membership are sometimes called close corporations. In this country[52] the power to be a corporation is a franchise which can only exist through the legislature.

In municipal corporations the members are the citizens; the number is indefinite; one ceases to be a member when he moves from the town or city, while every new resident becomes a member when by law he becomes entitled to the privileges of local citizenship.

The laws which corporations may make for their own government are made under the several heads of by-laws, ordinances, rules, and regulations. These laws may be made by the governing body for any object not foreign to the corporate purposes. A municipal corporation, for example, makes ordinances for the cleaning and lighting of its streets, for the government of its police force, for the supply of water to its citizens, and for the punishment of all breaches of its regulations. A railway corporation establishes regulations for signals, for the running of trains, for freight connections, for the conduct of its passengers, and for hundreds of other things. But such by-laws and regulations must be in harmony with the charter of the corporation and with the general law of the land. For instance, a municipal corporation could not enforce a by-law forbidding the use of its streets by others than its own citizens, because by general law all highways are open to the common use of all the people. Again, a railway corporation could not make a rule that it would carry goods for one class of persons only, because as a common carrier the law requires that it carry impartially for all.

As a general rule private corporations organised under the laws of one State are permitted to do business in other States. It is quite often to the advantage of a company to organise under the laws of one State for the purpose of doing business in another. For instance, there are many companies chartered under the laws of[53] Maine with headquarters in Boston. The Massachusetts laws require that a large proportion of the capital be actually paid in at the time of organising, while the Maine law has no such provision. For similar reasons many large companies doing business in New York or Philadelphia are organised under the laws of New Jersey.

A corporation may make an assignment just as may an individual. If all the members die the property interests pass to the rightful heirs, and under ordinary conditions the corporation still exists.

A franchise is a right granted by the State or by a municipal corporation to individuals or to a private corporation. The franchise of a railroad company is the right to operate its road. Such franchise has a value entirely distinct from the value of the plant or the ordinary property of the corporation.

An unlimited liability corporation is one in which the stockholders are liable as partners, each for the full indebtedness.

A limited liability corporation is one in which the stockholders, in case of the failure of the corporation, are liable for the amount of their subscriptions. The name limited is required by law to appear after the name of the company. If a subscription is entirely paid up there is no further liability—that is to say, the property of a shareholder cannot be attached for any debts of the company. Understand clearly that the name limited printed after the name of a company does not indicate in any way that the capital or credit of the company is limited, only that the liability of the shareholders of the company is limited to the amounts of their shares.

A double liability corporation is one in which, in case of failure, the stockholders are further liable for amounts equal to their subscriptions. All national banks are double liability companies. If A owns $5000 stock in a[54] national bank, and the bank fails, he loses his stock; and if the liabilities of the bank are large he may be obliged to pay a part or the whole of an additional $5000.

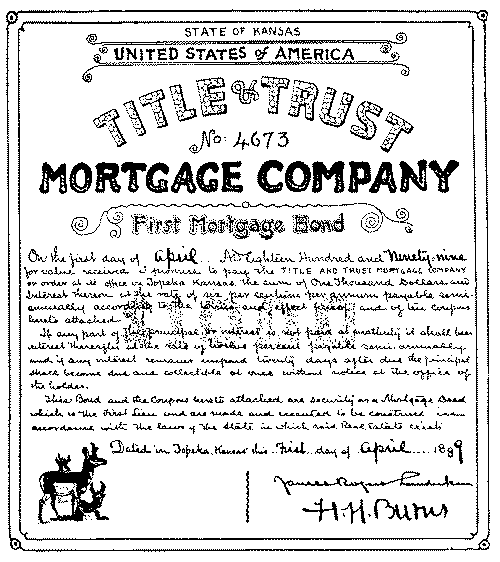

XVI. BONDS

When a railroad company, or a city or any other corporation desires to borrow money it is a common practice to issue instruments of credit called bonds. A bond means something that binds. Bonds bear the same relation to the resources of a corporation that mortgages do to real estate.

Corporation bonds are issued for a period of years. They usually have coupons attached which are cut off and presented at regular intervals for the payment of interest. A bondholder of a corporation runs less risk than a stockholder, first, as to interest: the corporation is obliged to pay interest on its bonds, but may at its own pleasure pass its dividends; secondly, the bondholder is a creditor, while the stockholder of the corporation is the debtor. On the other hand, if a concern is very successful, a shareholder may receive large dividends, while the bondholder receives only the stipulated interest. A bond is evidence of debt, specifying the interest, and stating when the principal shall be paid; a certificate of stock is evidence that the owner is a part-owner in the corporation or company, not a creditor, and he has no right to regain his money except by the sale of his stock, or through the winding up of the company's business.

The name debentures is given to a form of municipal bond in common use. Nearly all the large sums of money used by States and cities for the building of State or municipal buildings, bridges, canals, water-works, etc.,[55] are raised through the issue of bonds (debentures), which are sold, usually at a price a little below par, to large financial institutions, banks, and insurance companies. Generally speaking, such bonds are good securities, and are marketable anywhere.

[56]At different times the United States government has issued bonds to relieve the treasury. These bonds are absolutely safe and are always marketable. Registered bonds have the name of the buyer registered; unregistered bonds are payable to bearer. Municipal bonds are issued by cities and other municipalities to raise money for local improvements. If proper precautions are taken by buyers, municipal securities may be considered among the safest and most remunerative investments.

When a new railroad enterprise is undertaken its promoters often expect to make the road not only supply the money for its construction but also give working capital in addition. This is done by the issue of mortgage bonds. Default in the payment of interest throws the road into the hands of a receiver. The securities immediately fall in value and are perhaps bought up by a syndicate of crafty speculators who are permitted to reorganise the road and its management. This is the history of many of our roads. There are exceptional cases, of course, but the investor should be familiar with the facts before buying railroad mortgages.

A bottomry bond is a kind of mortgage peculiar to shipping. It is a conveyance of the ship as security for advances made to the owner. If the ship is lost the creditor loses his money and has no claim against the owner personally. It is allowable for a loan made upon such a bond to bear any rate of interest in excess of the legal rate. A vessel arriving in a foreign port may require repairs and supplies before she can proceed farther on her voyage, and in occasions of this kind a bottomry[57] bond is given. The owner or master pledges the keel or bottom of the ship—a part, in fact, for the whole—as security.

We have now upon the market stocks and bonds representing all conceivable kinds of property. Not only are properties of many kinds used to issue bonds upon, but many kinds of bonds are often issued upon the same property. Thus we find among our railroads not only first, second, and third mortgage bonds, but income bonds, dividend bonds, convertible bonds, consolidated bonds, redemption bonds, renewal bonds, sinking-fund bonds, collateral trust bonds, equipment bonds, etc., until they lap and overlap in seemingly endless confusion.

Receiver's certificates are issued by receivers of corporations, companies, etc., in financial difficulties, to secure operating capital; they are granted first rights upon the property and are placed above prior lien and first mortgage bonds.

XVII. TRANSPORTATION

The most common effect of cheapened transportation is to increase the distance at which it is possible for producer and consumer to deal with each other. To the producer it offers a wider market and to the consumer a more varied source of supply. On the whole, cheapened transportation is more uniformly beneficial to the consumer; its temporary advantage to the producer very often leads to overproduction. It has the effect also of bringing about nearly uniform prices the world over.

The time was when nearness to market was of the greatest possible advantage. At the present time a farmer can raise his celery in Michigan or his beets in Dakota and market them in New York City about as[58] easily as though he lived on Long Island. It is no longer location which determines the business to be carried on in a particular place, but natural advantages more or less independent of location. But the railroad or the steamboat very often determines where a new business shall be developed. It is this quickening and cheapening of transportation that has given such stimulus in the present day to the growth of large cities. It enables them to draw cheap food from a far larger territory, and it causes business to locate where the widest selling connection is to be had, rather than where the goods or raw materials are most easily procured. It is the quick and comfortable transportation facilities which our large cities possess that have given strength to the great shopping centres. Shoppers for thirty or forty miles around can easily reach these centres, and the result is that trade gathers in centres rather than at local points. A city of a million population in the most productive agricultural section of country could not be fed if the food had to reach the city by teaming. With this growth of trade centres comes the increased gain of large dealers at the expense of the small; with it comes organised speculation and its attendant results, good and evil.

Prior to the completion of the organisation of trunk or through lines, freight was compelled to break bulk and suffer trans-shipment at the end of each line, where a new corporation took up the traffic and carried it beyond. To prevent this breaking of bulk and to expedite the carriage of freight, fast freight lines on separate capitalisation were organised. The purpose of the interstate-commerce law is largely to prevent discrimination and corruption in freight charges, to secure for every person and place just and equal treatment at the hands of the transportation companies. The freight rates are arranged and regulated by the traffic associations, and the various[59] conditions and compromises necessary have made both classifications and rates about as complicated as anything possibly could be.

The name differential as applied to freight rates refers to the differences which are made by railroad companies. Certain roads are by agreement allowed to charge a lower rate than others running to the same points. To and from each of the eastern cities there are two classes of roads—the standard lines and the differential lines. The standard lines have the advantage of more direct connections; the differential lines reach the freight destinations by circuitous routes, in some instances by almost double the mileage. With a view to equalising these conditions the general traffic associations allow the differential lines to carry freight at a lower rate per mile than the rate charged by the standard lines.

The transportation business of the United States is so varied and complicated that a proper study of its freight tariffs and classifications would require much more space than can be given the subject in these lessons.

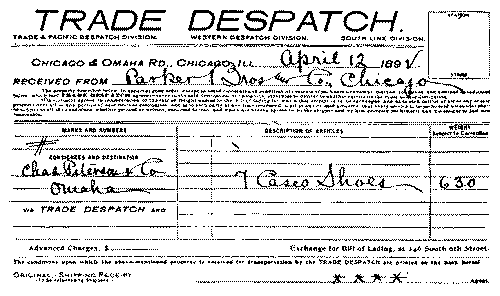

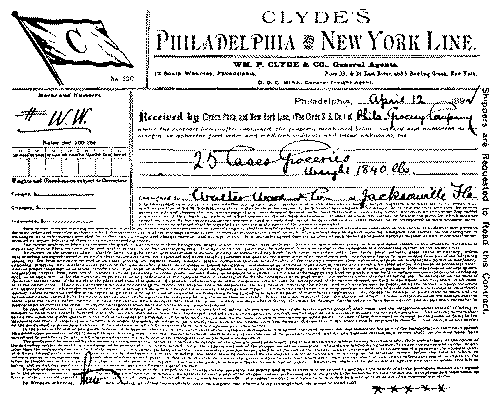

XVIII. TRANSPORTATION PAPERS

The common transportation papers, familiar to all shippers, are the (1) shipping receipt, (2) bill of lading, (3) waybill.

Original receipts, stating marks and quantities of goods, go with each separate lot of merchandise to the freight sheds or vessels, and these are summed up in a formal bill of lading, for which they are exchanged when all the cases or bundles belonging to the particular shipment have been delivered. The duplicate receipt, or the part commonly marked invoice, is kept by the receiver of the freight, and the other end, commonly marked original,[60] is given to the drayman. In making ordinary shipments it is not usual or necessary to make out a formal bill of lading. Of course, when no bill of lading is made out, the receipt should be preserved by the shipper. The full contract is usually printed on the receipt, but it must be remembered that a receipt is not a negotiable instrument and cannot be used as security for money.